© Reuters.

Investing.com– Most Asian stocks moved in a flat-to-low range on Thursday in anticipation of more cues on U.S. interest rates from key inflation data, while Chinese markets rebounded from heavy losses in the prior session.

Regional markets tracked a middling overnight session on Wall Street, while U.S. stock futures fell in Asian trade as several Federal Reserve officials also warned that the central bank had much more work to do in bringing down inflation.

Their comments saw markets grow even more anxious ahead of data- the Fed’s preferred inflation gauge, which is due later in the day. The reading is expected to reiterate that U.S. inflation remained sticky in January.

Japanese shares fall further from record highs amid middling data

Japan’s index fell 0.4%, while the broader lost 0.3% as both indexes fell further from record highs hit earlier in the week.

A batch of economic readings released on Thursday provided a mixed picture of the Japanese economy. While grew more than expected in January, shrank much more than expected.

The data came amid increasing uncertainty over when the Bank of Japan plans to begin raising interest rates. Hotter-than-expected released earlier this week ramped up bets that the BOJ could end its negative interest rate regime by as soon as April.

Chinese markets rebound from steep losses; PMIs awaited

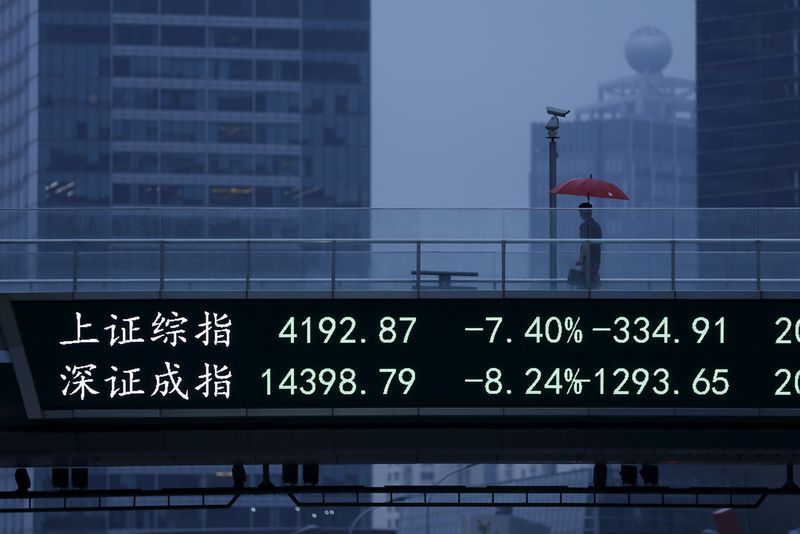

China’s and indexes rose 0.8% and 0.9%, respectively, after tumbling more than 1% each in the prior session on renewed concerns over a property market crisis. The concerns came after embattled developer Country Garden Holdings Company Ltd (HK:) was hit with a liquidation petition by a creditor.

Thursday’s gains were driven by China’s security regulator vowing to further tighten its hold on the derivatives market to increase investor confidence. The regulator had introduced a series of new curbs in recent weeks, including the limiting of short-selling, to help boost local markets.

Hong Kong’s index rose 0.2%, with gains limited after on Wednesday showed the economy grew slightly less than expected in the fourth quarter.

Focus is now squarely on key Chinese data for February, due this Friday, which is expected to offer more cues on a potential economic recovery in the country.

Broader Asian markets moved in a flat-to-low range. Australia’s was flat after data showed grew less than expected in January, amid continued pressure from high inflation and interest rates.

South Korea’s fell 0.5% amid some profit-taking after strong gains in the prior session, especially in chipmaking stocks.

Futures for India’s index pointed to a flat open after the index tumbled over 1% on Wednesday in a heavy bout of profit-taking.

Indian investors were also skittish ahead of key due later on Thursday, which is expected to show some moderation in an otherwise stellar economic run.

Read the full article here